What Parents Need to Know About the Oklahoma Alternate Assessment Program (OAAP)

If your child has a disability, you’ve likely heard about state assessments. But what if the school says your child should take the Oklahoma...

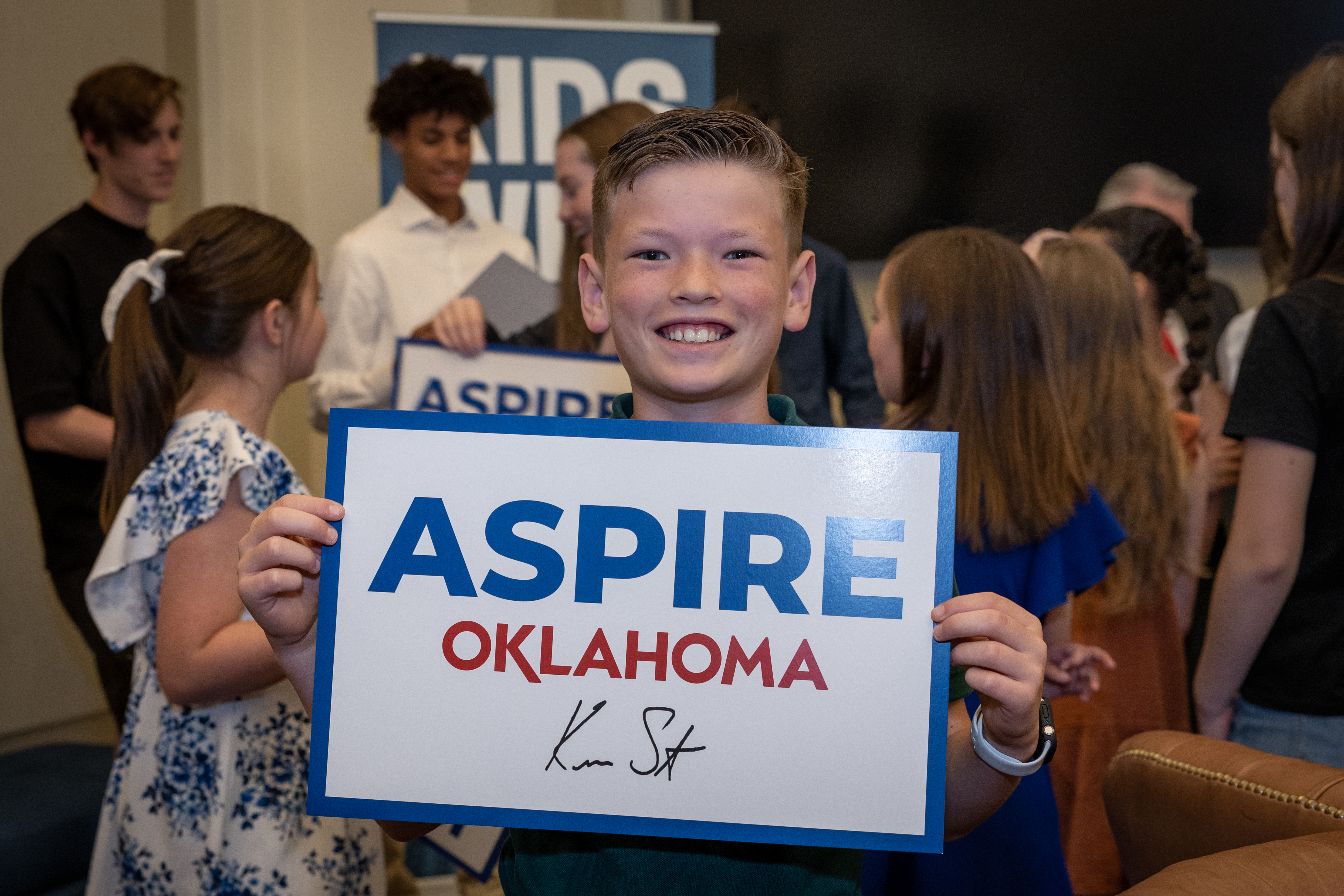

OPSA partnered with public and private school parents and students to express all of our thanks for the historic ASPIRE Oklahoma Plan. Governor Kevin Stitt was joined by students, parents, and school leaders from across the state to sign the ASPIRE Oklahoma Plan; a first-of-its-kind education freedom program and record funding in Oklahoma schools. Every student wins!

We have tried to cover everything currently known about the plan, however, as the Oklahoma State Department of Education (OSDE) and the Oklahoma Tax Commission (OTC) make decisions about the plan's implementation, more information will be added to the relevant blog post (homeschool, private school, and public school). We suggest you bookmark the blog posts below and check back frequently for the most up-to-date information. In the meantime, you can email any questions to our Director of Parent Services, Lucia Frohling, at LFrohling@okpsaedu.org

Want to learn more about the Oklahoma Parental Choice Tax Credit of the ASPIRE Oklahoma Plan for homeschool parents? Check out this blog post.

Want to learn more about the Oklahoma Parental Choice Tax Credit of the ASPIRE Oklahoma Plan for private parents? Check out this blog post.

Want to learn more about the historic public school investment portion of the ASPIRE Oklahoma Plan? Check out this blog post.

Disclaimer: The information provided in this material does not, and is not intended to, constitute legal or tax advice. All information, content, and materials are for general informational purposes only.

Readers of this material should contact their attorney or tax professional to obtain advice with respect to any particular legal or tax-related matter. The information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation.

The views expressed are those of the individual authors writing in their individual capacities only – not those of their respective employers, any state agency, or committee/task force as a whole. All liability with respect to actions taken or not taken based on the contents of this material are hereby expressly disclaimed. The content on this material is provided "as is;" no representations are made that the content is error-free.

If your child has a disability, you’ve likely heard about state assessments. But what if the school says your child should take the Oklahoma...

Big news for Oklahoma parents who have students with disabilities! On July 1, 2025, a new law, House Bill 1393, will go into effect, giving parents...

Oklahoma's Parental Choice Tax Credit is getting a makeover starting July 1, 2025, thanks to Senate Bill 684 (SB 684), and it’s great news for...